Introducing Aleo Tokens

Aleo tokens allow users and developers to secure verification and data services on the decentralized network and compensate service providers for their work to benefit the entire Aleo open-source ecosystem.

How the Aleo Token works

Granting access

Aleo Tokens are used to access blockspace and computational resources on the network, with users paying Tokens to submit transactions and have them processed.

Creating incentives

Provers and validators are rewarded in Aleo Tokens by the protocol for securing it, incentivizing a robust decentralized network.

Enabling staking

Aleo Tokens can be staked with validators to produce blocks and provide network security, with stakers receiving a pro-rata share of network rewards in return.

Powering governance

After mainnet launch, Aleo Token holders may participate in decentralized governance, voting on upgrades and changes to the protocol.

How Aleo Tokens are distributed

Strategic Partners8%

Aleo Network Foundation & Provable16%

Employees & Project Contributors17%

Grants & Education25%

Early Backers34%

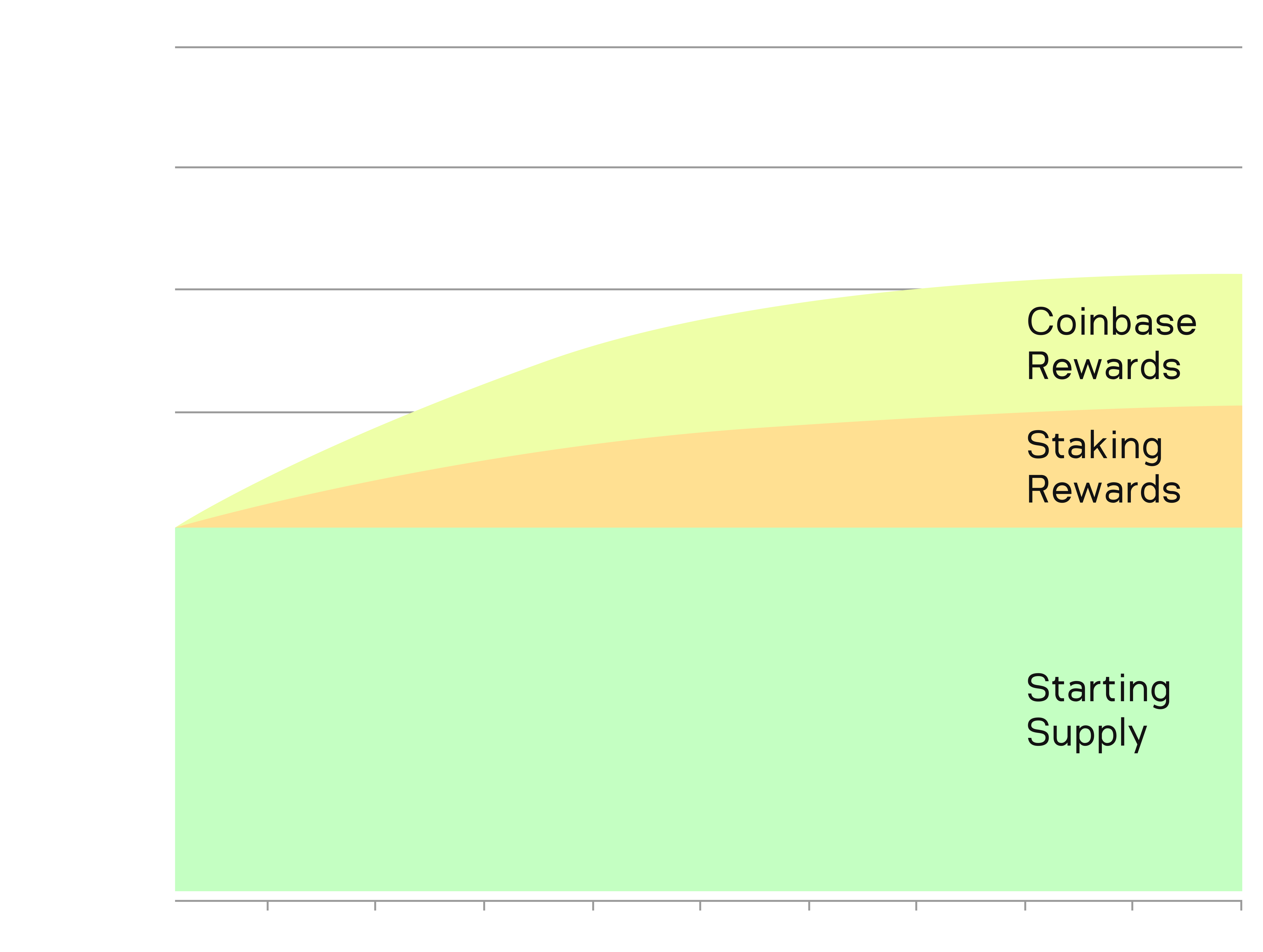

Inflation

The inflation rate decreases over time from around 12% in year 1, to 2% in year 10, approaching 0% over time.

Block rewards

Validators also earn a constant block reward (currently set at 23 Tokens per block) in perpetuity as an incentive to keep validating.

Circulating supply

The total circulating supply of Aleo Tokens grows to 2.6 billion over 10 years, and doubles in about 21 years, as rewards are issued.

Rewards

The Aleo Network issues Aleo Tokens as rewards to provers for solving puzzles, and validators for securing the network and participating in consensus. Provers are responsible for generating zero-knowledge proofs that validate the correctness of a transaction or computation. In the context of Aleo, these proofs are used to ensure that transactions are valid while keeping the transaction data completely private. By solving computational puzzles, known as Coinbase Puzzles, provers are rewarded with ALEO tokens thus incentivizing the development of efficient hardware for proof generation. Every epoch (360 blocks) the Coinbase Puzzle changes, requiring provers to shift to computing the new Puzzles to continue having solutions accepted by the network. The generation of ZKPs requires significant computational power, but provers are not required to stake or lock any ALEO tokens. Provers are compensated with ALEO tokens for each valid proof they generate and submit through Coinbase rewards. Coinbase rewards are set to decrease by 10% annually until year 9 when they will be set at a fixed rate.

Over 10 years, more than 50% of Aleo Tokens will be distributed to the public.

Explore the Aleo Network

0

0

%

%

Proves without revealing, transacts without exposing, complies compromising to meet real-world needs

Payments

The future of payments demands both privacy and compliance. Aleo safeguards user data while meeting regulations-empowering use cases like global payroll and cross-border payments.

Explore Use caseRequest Finance is a business finance platform that has processed over $1 billion in payments, enabling companies to manage crypto and fiat payroll and vendor payments while keeping financial information secure and confidential.

Payments

The future of payments demands both privacy and compliance. Aleo safeguards user data while meeting regulations-empowering use cases like global payroll and cross-border payments.

Explore Use caseTry it outRequest Finance is a business finance platform that has processed over $1 billion in payments, enabling companies to manage crypto and fiat payroll and vendor payments while keeping financial information secure and confidential.

Aleo for Identity

Aleo drives the future of digital identity with secure authentication and protection from mass data leaks. Its flexible design supports a wide range of use cases-from online age assurance for kids to meeting zero-knowledge digital ID requirements.

Explore Use caseTry it outExplore

Aleo Name Service

ANS is a name registrar on the Aleo Network that transforms complex addresses into confidential, easily memorable names, simplifying and securing interactions.

zPass is a privacy-focused solution that allows users to prove identity information to third parties, securely, using pre-verified documents, user data, and digital signatures without revealing more personal information than you need to.

Aleo for Gaming

Aleo enables provable fairness and privacy—players can own assets, transact securely, and maintain confidentiality without compromising verifiability

Explore Use caseTry it outPuzzle Arcade is building the first onchain world arcade where people can play NYT style games. Their wallet-native distribution with reward mechanics is only possible with zero-knowledge privacy and scalability.

Aleo for DeFi

Private-by-default peer-to-peer financial services enabling open, fair markets while ensuring user privacy and regulatory compliance.

Explore Use case