Introduction to Aleo Tokenomics

The heart of the Aleo Network is the community — the folks who learn, build, and believe in the power of ZK to create a more secure and private world. As a result, the design of Aleo’s tokenomics, which plays a crucial role in shaping the incentives, governance, and network sustainability, was developed with care and based on extensive research, and with the intent of encouraging a vibrant ecosystem of developers.

Read on to learn about the network’s tokenomics, which will power the ecosystem at mainnet launch.

What are Aleo Tokens?

The Aleo Token is the native asset of the network that allows holders to pay for services from a marketplace of competitive, unaffiliated entities, companies, or individuals for the purpose of updating the ledger. Instead of buying tokens from one company, you are buying network tokens that you can use amongst distributed, unaffiliated nodes on the internet. By participating on the Aleo Network, you interact with an open-source provider ecosystem rather than any specific company or institution. Aleo Tokens do not represent an investment opportunity.

The Aleo Token allows:

Users and developers to secure verification and data services.

Service providers to distribute compensation units for their finite time and computing resources.

The Aleo Network to be a competitive and mutually beneficial ecosystem, with the token helping deter spam and bad faith use of the network (e.g., being flooded by bots).

What are Aleo Tokens used for?

Aleo Tokens serve several purposes on the Aleo Network, including:

Granting access. Tokens are used to access blockspace and computational resources on the network, with users paying them to submit transactions and have them processed.

Creating incentives. Provers and validators are rewarded in tokens by the protocol for securing it, incentivizing a robust decentralized network.

Enabling staking. Tokens can be staked with validators to produce blocks and provide network security, with stakers receiving a pro-rata share of network rewards in return.

Powering governance. After mainnet launch, Aleo Token holders may participate in decentralized governance, voting on upgrades and changes to the protocol.

How does Aleo's tokenomics work?

Tokenomics is a term that describes the economic system and mechanism of a cryptocurrency or token — or, in the case of Aleo, the Aleo Token. At launch, there will be 1.5 billion Aleo Tokens. After launch, the consensus algorithm will auto-generate tokens to reward puzzle-solving provers and stakers.

Similar to Bitcoin, the Aleo Network is secured by economic incentives. Specifically, the protocol issues new Aleo Tokens algorithmically to participants who follow the protocol honestly. Validators earn Aleo Tokens for validating transactions and creating blocks, and provers earn tokens by contributing their computational resources to generating proofs, which help secure and facilitate transactions.

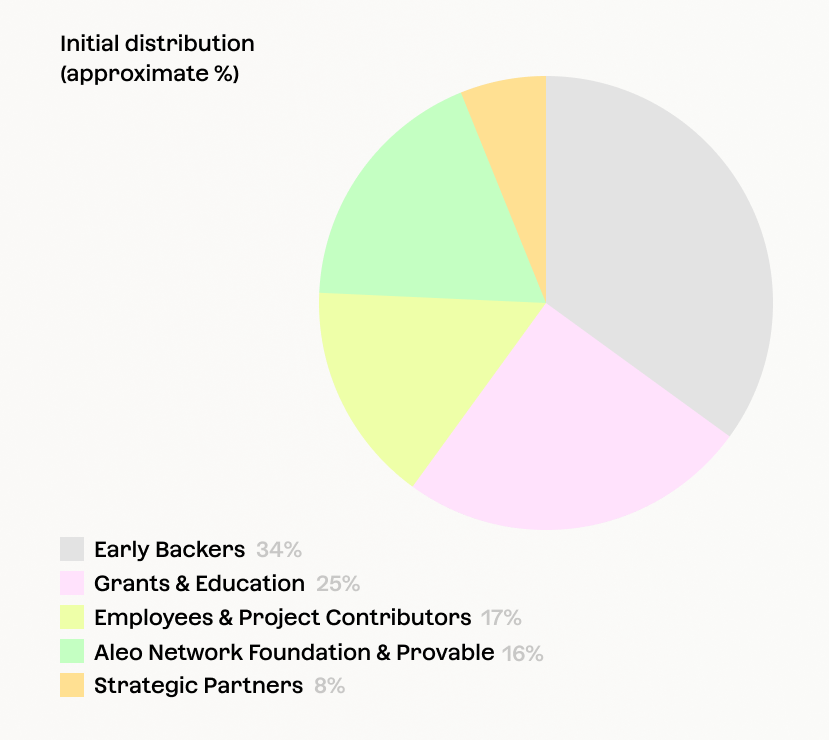

Aleo Tokens will be approximately allocated as follows:

34% to early backers

25% for grants, ecosystem contributors, and education

17% to employees and project contributors

16% split between the Aleo Foundation and Provable

8% to strategic partners

Does the distribution of tokens change over time?

The distribution of tokens changes naturally and algorithmically. Provers and validators (with fixed and variable operating costs) may sell their tokens to pay for their expenses, meaning the distribution will naturally move away from initial holders. The rewards earned by validators are emitted at a constant rate of 23 tokens per block in perpetuity.

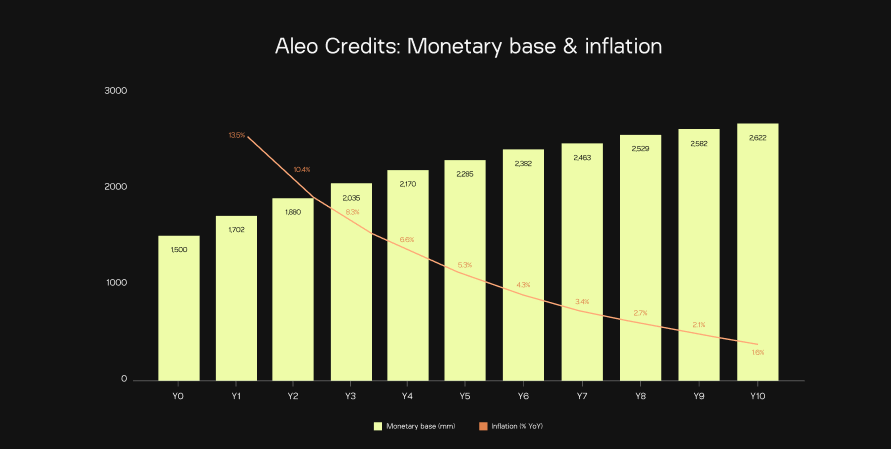

Algorithmically, the distribution will change significantly because the staking and proving rewards will increase the circulating supply of tokens by approximately 75% (from 1.5B to over 2.6B) in ten years. This emission rate will decrease from 13.5% in year one to 1.6% in year ten. The chart below illustrates the expected Aleo Tokens monetary base and inflation rate over time.

Together, we can unlock the next generation of applications on the internet — applications that can more securely manage data while expanding access to online services.